lowest sales tax in orange county california

There is no applicable city tax. Heres how Los Angeles Countys maximum sales tax rate of 105 compares.

Orange County Condo Prices Hit All Time High As Buyers Are Priced Out Of House Market Orange County Register

City of Calexico 825 City of El Centro 825.

. City of Arcata 850 City of Eureka 925 City of Fortuna 850 City of Rio Dell 875 City of Trinidad 850. California CA Sales Tax Rates by City The state sales tax rate in California is 7250. INYO COUNTY 775.

The December 2020 total local sales tax rate was also 7750. The Orange County Sales Tax is collected by the merchant on all qualifying sales made. The minimum combined 2022 sales tax rate for Orange County California is.

KERN COUNTY 725. Which city has the lowest sales tax in california. HUMBOLDT COUNTY 775.

This is the total of state and county sales tax rates. On top of the states minimum sales tax individual counties and cities also charge a sales tax. Only about a quarter of the cities in California actually charge a sales tax of 725.

The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. Some forums can only be seen by registered members. A county-wide sales tax rate of 025 is applicable to localities in Los Angeles County in addition to the 6 California sales tax.

Sales tax listed by zipcode sorted lowest sales tax Orange. Property Tax in Orange County. You can use the California property tax map to the left to compare Orange Countys property tax to other counties in California.

California has 2558 cities counties and special districts that collect a local sales tax in addition to the California state sales taxClick any locality for a full breakdown of local property taxes or visit our California sales tax calculator to lookup local rates by zip code. Lowest sales tax NA Highest sales. With local taxes the total sales tax rate is between 7250 and 10500California has recent rate changes Wed Jan 01 2020California CA Sales Tax Rates by CityCity Total Sales Tax Rate San Bernardino 8000 San Diego 7750 San Francisco 8500 San Jose 9250.

The 2018 United States Supreme Court decision in South Dakota v. Heres how San Diego Countys maximum sales tax rate of 875 compares to other. The California state sales tax rate is currently.

The Los Angeles County Sales Tax is 025. The San Diego County Sales Tax is 025. The current total local sales tax rate in Orange County CA is 7750.

Some cities and local governments in San Diego County collect additional local sales taxes which can be as high as 25. The total Orange County sales tax for most OC cities is 775. City of Orland 775.

Balboa Island Newport Beach 7750. There are 41 counties in the state with higher property taxes and only 15 counties that have lower rates. Please note that this is the base tax rate without special assessments or Mello Roos which can make the rate much higher.

If you need access to a database of all California local sales tax rates visit the sales tax data page. Home purchase User Name. As an example consider Los Angeles County.

175 lower than the maximum sales tax in CA. City-Data Forum US. The county has a sales tax of 95.

Orange County Sales TaxDefense Lawyer. The 775 sales tax rate in Orange consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. For tax rates in other cities see California sales taxes by city and county.

You can print a 775 sales tax table here. The state sales tax rate in California is 7250. Marin County collects the highest property tax in California levying an average of 550000 063 of median home value yearly in property taxes while Modoc County has the lowest property tax in the state collecting an average tax of 95300 06 of.

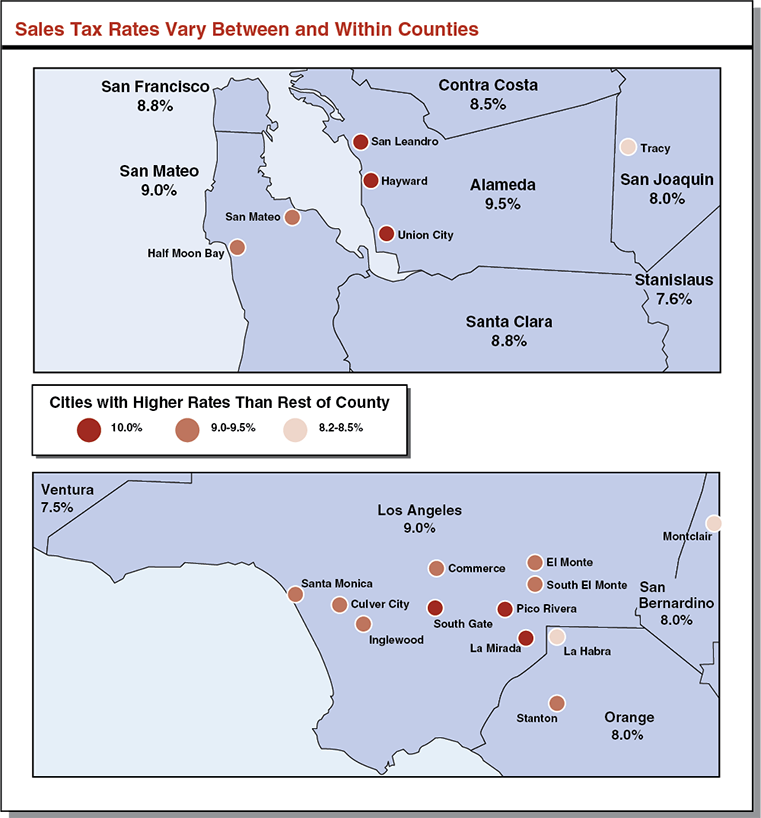

A county-wide sales tax rate of 025 is applicable to localities in San Diego County in addition to the 6 California sales tax. Here Ventura County has the lowest rate75 percentwhile three cities in Los Angeles County have 10 percent rates. As California property tax rates go Orange County is on the low end at only 1061.

Please register to participate in our discussions with 2 million other members - its free and quick. Several cities in this area have 10 percent rates while nearby Stanislaus County has a 76 percent rateone-eighth of a cent above the minimum. The following chart shows average annual property tax rates for each Orange County city for a 3-bedroom single family home.

82 rows The total sales tax rate in any given location can be broken down into state county city. The bottom panel of the figure displays sales tax rates in the Los Angeles region. With local taxes the total sales tax rate is between 7250 and 10750.

Californias State Board of Equalization SBE imposes sales tax on gross receipts from retail sales and requires the retailers and re-sellers to collect all sales taxes and then forward these collected taxes in a pre-determined and timely fashion to the State Board of Equalization. Within the county a handful of cities charge a higher sales tax. A combined city and county sales tax rate of 175 on top of Californias 6 base makes Anaheim one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower.

Has impacted many state nexus laws and sales tax collection requirements. Orange County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Orange County totaling 025. City of Arvin 825 City of Bakersfield 825.

2022 List of California Local Sales Tax Rates. You can find more tax rates and allowances for Orange County and California in the 2022 California Tax Tables. The Orange County sales tax rate is.

IMPERIAL COUNTY 775. Some cities and local governments in Los Angeles County collect additional local sales taxes which can be as high as 425. Property Tax in Orange County.

Note that 1061 is an effective tax rate estimate. 10 rows Sales Tax in Orange County. Balboa Park San Diego.

City of Bishop 875.

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Rancho Mission Viejo Sells Out Another Home Project Orange County Register

Bad Map Example No Normalization And Too Many Colors And Categories Income Tax Map Amazing Maps

Orange County Irs Tax Lawyer California Instant Tax Attorney Places To Visit Places To Go Orange County

Orange California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Top 10 Healthiest Cities In Us Centrum New Orleans Healthy

Orange County Property Tax Oc Tax Collector Tax Specialists

California Sales Tax Rates Vary By City And County Econtax Blog

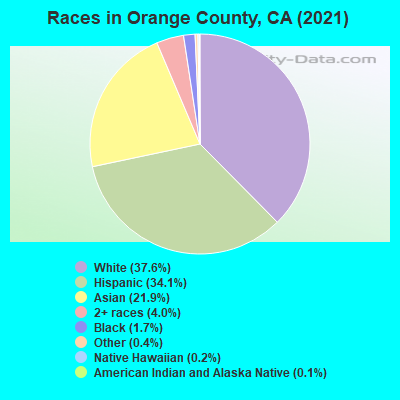

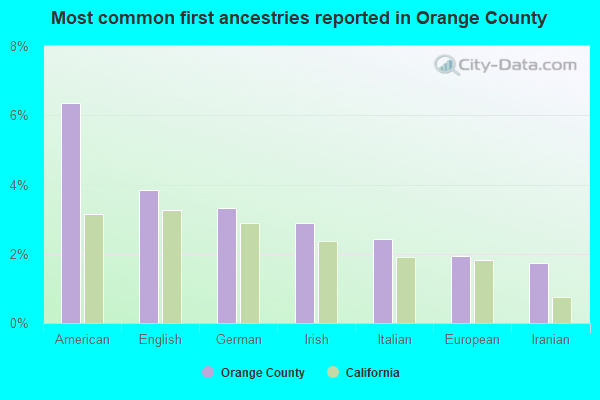

Orange County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Where Are The Nation S Most Financially Stressed Homeowners O C And L A Homeowner National Santa Ana

Orange California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

35 Reasons Why Living In Orange County Is So Expensive Orange County Register

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

California Has Trillions More Wealth Than Any Other State California New Hampshire Maryland

Flights To Orange County Anaheim Sna From Calgary Yyc Westjet Official Site

Orange County Value At Risk Case

Orange County Ca Property Tax Search And Records Propertyshark

Orange County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More